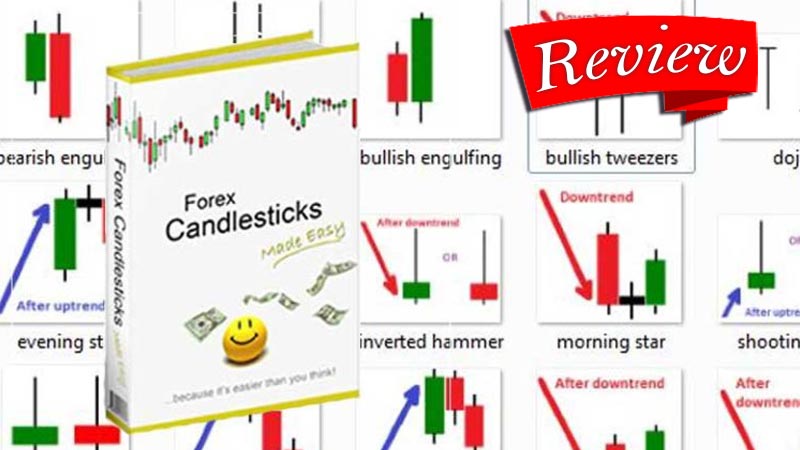

Forex Candlesticks Made Easy at a glance

$37Pros

- Is easy to ubnderstand, the concepts are clearly explained in such a way that you can easily understand.

- It is unique; techniques that you get from here will teach you insights from expensive trading seminars.

- Very safe; your content is absolutely protected 100%.

- Implementation of the techniques can be made immediately on getting the book.

- 60 days money back guarantee.

Cons

- The 100% success rate cannot be guaranteed. Additional research before trading may be helpful.

- Can only be found online.

For the sake of the few of us who have little knowledge when it comes to Forex matters, will begin by explaining what it is to you. No trouble at all. This review is all about you knowing what you can. Not a scam like other reviews that tend to coax a greater majority.

When we talk about a candlestick what we are referring to is a chart displaying the low, high, closing and opening prices of a given security over a period of time.

So what does the real body actually do? Here is what. It informs you as the investor whether the price at closing was higher or if it was lower than price at opening.

Just as the traffic lights you encounter in your daily life as you drive down the highway, the candlestick also uses different color lights as indicators.

A black or red light means that the closing stock was lower while a white or green color serves to show you that the stock closing was higher.

How They Work

The shape of a candle stick varies in relation to the day’s high, low, closing and the opening prices. Amazing, right?

These candlesticks affect the sentiments of the investor on prices of securities and are therefore useful to technical analysts in the determination of perfect timing to exit or enter trades. Are you in need of a method you can use to trade any liquid financial asset? Candlesticks is what you require. It trades the following:

- Foreign exchange

- Stocks

- Futures

When the candlesticks indications are long white or green, this implies that the buying pressure is strong. The price is bullish at such instances.

Two-Day Candlestick Trading Patterns

When it comes to candlestick patterns, there are many short-term strategies of trading. A pattern that is engulfing shows that a reversal in potential trend is probable; the body of the first candlestick is small and it is completely engulfed by the second candlestick.

This engulfing pattern is referred to as bullish engulfing and appears at the end of the downtrend. Another pattern, bearish engulfing, appears at the uptrend conclusion.

Three-Day Candlestick Trading Pattern

Bearish reversal pattern in which the first candlestick progresses with the uptrend is an evening star. The second candlestick has a body that is narrow and links up. Closing below midpoint of first candlestick is made by the third candlestick.

A long black or red bodied first candlestick is present in bullish reversal pattern that we call morning star. It is followed by a short candlestick that has linked lower; this is completed with long white or green candlestick that closes higher than the midpoint of first candlestick.

Bullish Belt Hold

A trend may occur during a movement downwards in candlestick. The formation of a white candlestick or bullish candlestick closely follows a stretch of bearish candlesticks.

At such, the price at opening is very low compared to the closing price and becomes the low of the day. The result is long white candlestick that has an upper shadow that is short and lacks in lower shadow.

This Bullish Belt Hold mostly indicates a reverse in the sentiments of the investor from bearish to bullish. As a result of the trend being a common occurrence, it is very rarely seen as useful. It is usually incorrect in the prediction of future prices of shares.

Charting patterns of candlesticks more than two days of doing trade should be given a consideration as you make predictions on the trends.

Making Forex Candlesticks Easy

Picture this case scenario, you are trading with the uptrend and your technical indicators indicate to you that the prices are likely to continue moving up. A definite nice feeling about this will almost certainly get to you. Right? And you enter ‘Buy’ trade.

And somehow somewhere along the course, the market begins to make movement in the exact opposite direction. How frustrating would that be? You will be reduced to just as the prices move nearer and nearer to your stop-loss level.

The Answer:

As in all aspects of business the world over, disciplined is a virtue that you should hold high. Keep calm and watch as you wait.

In a matter of hours, you will experience the ‘Ding!’ sound. You definitely know what that implies. The trading platform tells you the triggering of your stop-loss order. Why you? Why does it keep on screwing you?

Over the next eight hours or so, you watch hardly believing your eyes as the market rises 90 pips in the initial direction. How? You were not wrong in deciding not to get stopped out so soon.

As you would learn from this, the identification of the trend in prices is not enough. What you really need is the knowledge on the perfect timing to enter the market.

Which other review would let you in on this very effective candlestick techniques? I have not seen any reviews on such honestly.

This is neither a scam nor a hype. But of course you may tend to think that way from how good it really is. Making cash like a hobby. The creation of Christopher Lee.

Want to make accumulations of profits in the trading account you own? Here are a sure proven ways.

Let me start off by telling you that profitable Forex Trading is very simple.

The technical indicators that you usually use will only inform you the approximate happenings in the market. Well, they may be helpful but the limitation is that pinpointing exactly when to enter a trade is a challenge. When it comes to informing on when to exit trades, likewise they are very unreliable.

The definite indicator of how the market is doing at this time is candlesticks. They contain the most current information regarding the market.

Why candlesticks

By Christopher Lee’s creation, candlesticks, you get the latest information on the market. Why should you continue listening to some currency analysts when the answer on market progress is clearly on the trading chart? I see no reason. Correctness is guaranteed.

Pros

- Application is very easy; the concepts are clearly explained in such a way that you can easily understand.

- It is unique; techniques that you get from here will teach you insights from expensive trading seminars.

- It is very safe; your content is absolutely protected 100%.

- Speed; implementation of the techniques can be made immediately on getting the book.

- Private; this book is proprietary and I assure you that you cannot find it anywhere else.

Cons

- The 100% success rate cannot be guaranteed. Additional research before trading may be helpful.

- Can only be found online. As mentioned earlier, this book is proprietary and as a result cannot be found anywhere else apart from online. It becomes somewhat a challenge to access it.

Conclusion

Forex Candlesticks Made Easy is a very awesome expert and profit is assured of you as its user. It is definitely a book that you should go buy immediately.

Try Now… Click the Button Below